As the financial center of Southeast Asia and a developed country, Singapore's medical environment can be described as the world's top level. Can people who usually work and live in Singapore afford the expensive medical expenses? Yes, today we are going to see what kind of medical benefits the government has provided to the residents of Singapore.

No matter how healthy you are, you will always get sick. If you have a minor illness, it may not delay you much. But if you need to be hospitalized, you may know where the best way to save money is to stay in a high-end hospital and enjoy high-end medical treatment in Singapore after reading this article.

Let me sell a pass first, let's first understand the general cost of high-level hospitals under normal circumstances.

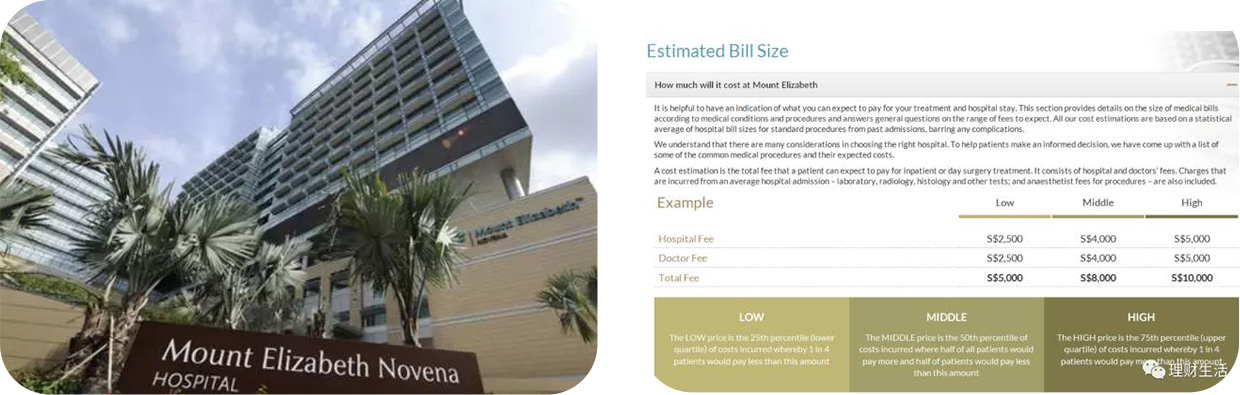

Mount e Elizabeth Hospital is the representative of the best private hospital in Singapore. The consumer price is also quite representative. The luxury environment is not elaborated. Let's take a look at the general short-term hospitalization charges

According to the statistics of the above hospitals, the expenses between $5000 and NT $10000 are ordinary consumption expenses. Do you feel it is not easy to earn money, and there will be no brawl when spending.

Some spectators may say that my work unit is very good, and the company's group insurance can basically cover all of them. If you have a headache, you still swagger to mount E and throw out the Shenton card. After reading it, you feel that you don't have to pay back the money, and the hospital owes you the same money. Congratulations first, but have you ever thought about what to do if you need a larger amount of medical expenses besides 15% of the expert outpatient fee if the fund exceeds the limit of the group's insurance( Generally, group insurance will vary according to the position of the company. Please consult your HR for details.)

What's more, some students just work in a small company, or study, or get PR but have no job?

If you are lucky to be a resident of Singapore, including citizen, PR, student permit, various work permit and family permit holders, let's see how to enjoy the best medical service with the least money.

If you have friends who apply for PR in Singapore, the government will force the applicants to buy a kind of insurance called medishield, and citizens are also forced to buy it. This insurance has a very strong government welfare plan, without physical examination. After being insured, any disease will continue to be covered unconditionally without premium.

A friend may also say, I bought medishield, private hospitals can't go, and many surgeries are not included, so the cost I bear is still very large.

There must be someone who has 10000 grass mud horses galloping by in his heart. What the hell, he can't go to the private hospital for half a day. So please be patient and look down

In addition to a large number of ships, the most important thing in Singapore is financial institutions, and insurance companies are also the main force. According to incomplete statistics, all the major insurance companies in Singapore should have such products. Take AIA as an example, and cooperate with medishield above, let's see the following figure:

Although the above are all numbers, but it is the key to this article, please check carefully.

Take 41-50 years old as an example

The government's medishield year is 435 new;

If you pay 419 yuan more than one year, you can enjoy the private hospital, but you have to bear at least 3000 yuan of new expenses, and the extra insurance company can only claim 90% of the amount except 3000 yuan;

If you pay 581 yuan more in one year, that is 1435 yuan more in one year, you can go to a private hospital and live in a hospital for all the diseases( The cost of hospitalization is not more than 600000 yuan, the cost of major diseases is not more than 700000 yuan, and the life quota is not limited). The cost of family beds and private nurses are also included.

If you don't stay in a private hospital, you will get 250 new grants a day if you transfer to a government hospital.

If you have resident status and do work overseas, can you not enjoy such benefits?

No, No. outside Singapore, all medical expenses of emergency hospitalization due to accidents are also covered.

According to experience, in China, people over the age of 60 are basically out of touch with all kinds of insurance. This product can even be purchased at the age of 99, and the premium is reasonable. If the government's welfare insurance plan is not included, I'm afraid the world can't buy this kind of insurance plan.

Therefore, I would like to ask you to consider whether it is an invisible welfare of the government.